Mergers and Acquisitions Strategy: A Comprehensive Guide

Mergers and acquisitions (M&A) are critical strategies for business growth and market expansion. Understanding the intricacies of these processes can provide companies with significant competitive advantages, enabling them to adapt to changing market conditions and seize new opportunities. This article will delve into the fundamental aspects of mergers and acquisitions strategy, providing insights into the entire M&A process, its challenges, and best practices for success.

:max_bytes(150000):strip_icc()/Mergers_and_Acquisitions_MA-b5ff09c3b79047e78e8d940bdc9f2760.png)

Understanding Mergers and Acquisitions

Definition of Mergers and Acquisitions

Mergers and acquisitions refer to the consolidation of companies or assets. A merger occurs when two companies combine to form a new entity, while an acquisition is when one company purchases another. These strategies are often employed to achieve growth, expand market reach, and realize synergies.

Importance of M&A in Business Growth

M&A can serve various strategic purposes, including:

- Market Expansion: Entering new markets through acquisition can significantly reduce entry barriers.

- Resource Acquisition: Gaining access to valuable resources, technology, or talent.

- Synergy Creation: Merging operations can lead to cost savings and increased efficiency.

- Increased Market Share: Acquiring competitors can enhance a company’s market position.

Types of Mergers and Acquisitions

Understanding the different types of M&A is essential for developing an effective strategy. The three primary categories include:

- Horizontal Mergers: Occur between companies at the same stage of production in the same industry, often to increase market share.

- Vertical Mergers: Involve companies at different stages of production within the same industry, aimed at improving supply chain efficiency.

- Conglomerate Mergers: Occur between companies in unrelated businesses, typically to diversify operations and reduce risk.

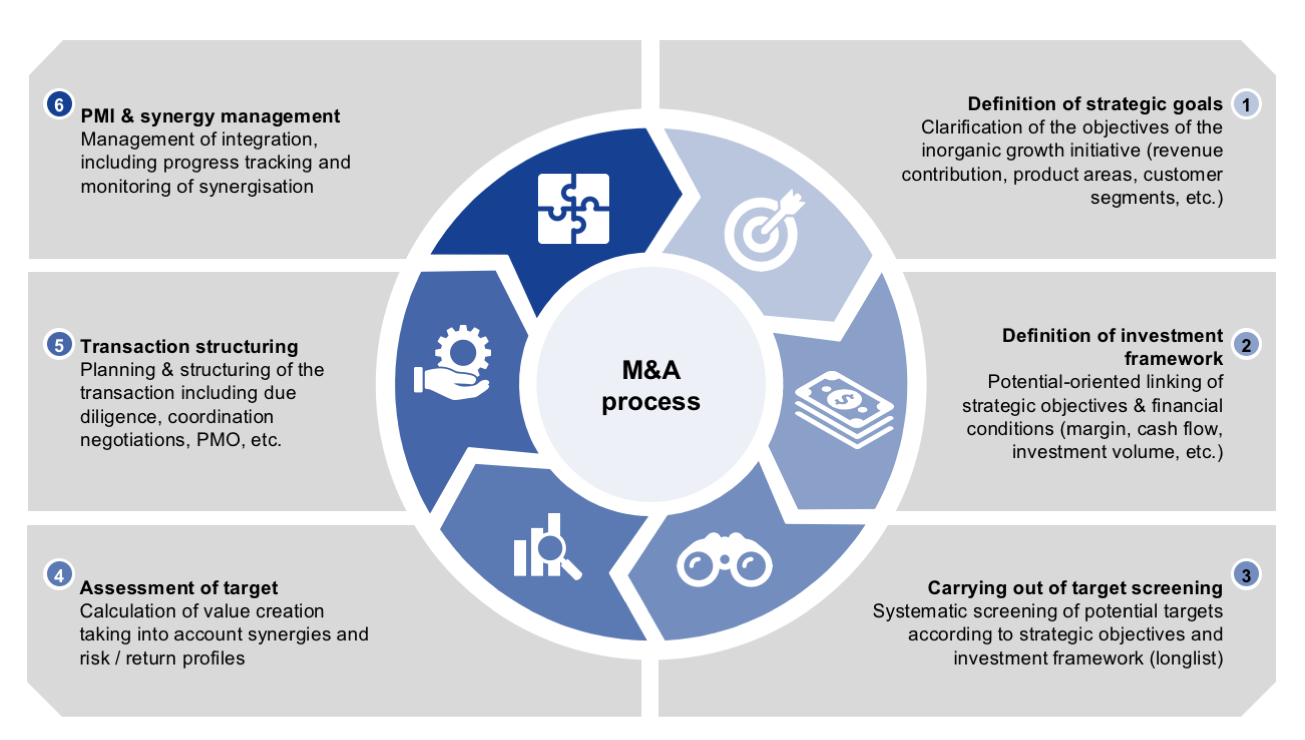

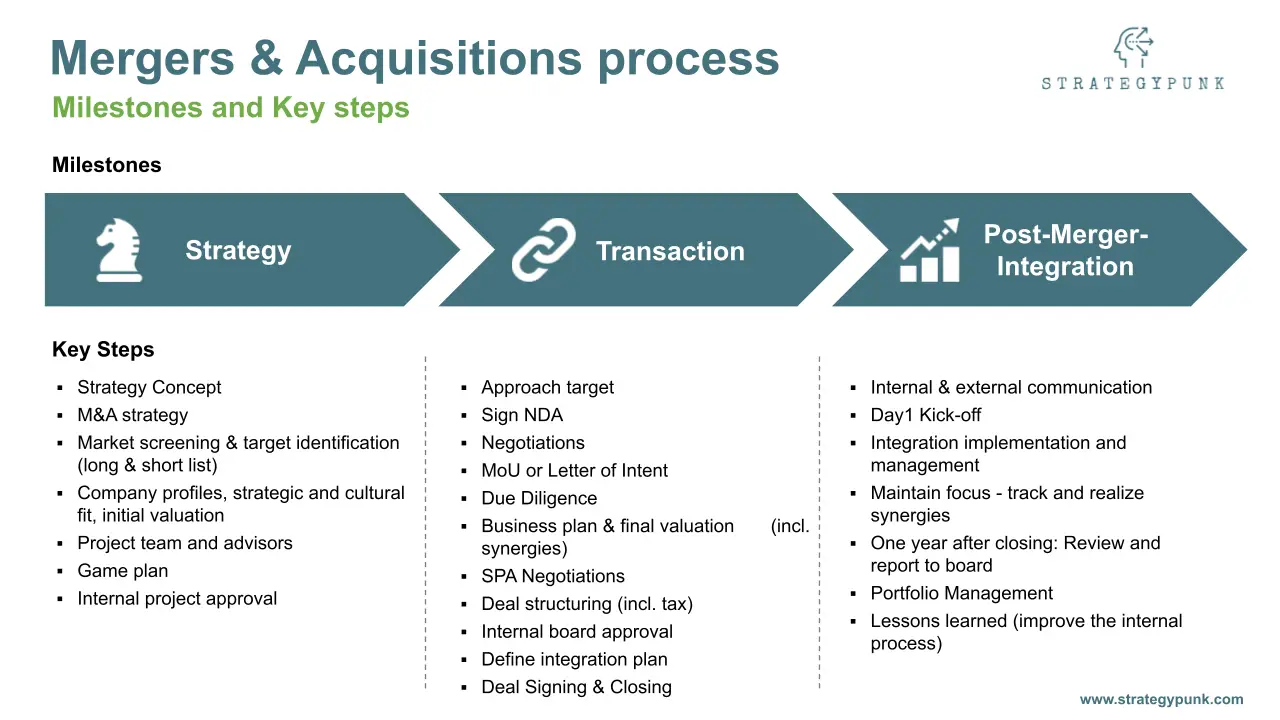

The M&A Process Overview

Pre-Merger Planning

The success of an M&A strategy heavily relies on thorough pre-merger planning. Key activities include:

Market Research and Analysis

Conducting comprehensive market research helps identify industry trends, customer preferences, and competitive dynamics. This analysis informs decision-making and strategy development. For a deeper understanding of market trends, refer to resources like Investopedia.

Identifying Potential Targets

Once the market landscape is understood, the next step is to identify potential acquisition targets. This involves evaluating companies based on strategic fit, financial health, and operational capabilities.

Due Diligence Procedures

Due diligence is a critical step in the M&A process. It involves a detailed assessment of the target company’s financial statements, operational processes, and legal obligations. This phase helps uncover any potential risks or liabilities that may impact the deal.

“Due diligence is about protecting your interests. It’s the necessary process that can make or break an acquisition.” – John Doe, M&A Consultant

Negotiation Strategies

Effective negotiation is vital to achieving favorable terms in an M&A deal. Key components include:

Valuation Techniques

Determining a fair value for the target company is essential. Common methods include discounted cash flow analysis, comparable company analysis, and precedent transactions.

Deal Structuring Options

M&A transactions can be structured in various ways, including stock purchases, asset purchases, or mergers. Each option has unique implications for taxation, liability, and operational control.

Execution of Mergers and Acquisitions

Once negotiations are finalized, the next phase is the execution of the M&A deal.

Closing the Deal

The closing process involves finalizing all legal documents and completing the financial transaction. It’s crucial to ensure all regulatory approvals are obtained before closing.

Regulatory Considerations

M&A transactions may be subject to scrutiny by regulatory bodies to prevent anti-competitive behavior. Companies must ensure compliance with antitrust laws and regulations in their respective jurisdictions.

Post-Merger Integration

The integration phase is critical to realizing the full potential of the merger or acquisition.

Importance of Integration Planning

Integration planning should begin early in the M&A process. A well-structured integration plan aligns both companies cultures, systems, and operations, facilitating a smoother transition.

Cultural Integration Challenges

One of the most significant challenges in post-merger integration is aligning the corporate cultures of the merging entities. Failure to address cultural differences can lead to employee dissatisfaction and decreased productivity.

Technology and Systems Integration

Integrating technology and systems is another crucial aspect. Companies must ensure that their IT systems, processes, and data are compatible to support efficient operations post-merger.

Measuring Success Post-Merger

To assess the effectiveness of an M&A strategy, organizations should establish clear metrics to measure success, including:

- Financial Performance: Analyzing revenue growth and profitability post-merger.

- Market Share: Monitoring changes in market share and competitive position.

- Employee Retention: Evaluating employee satisfaction and retention rates.

For further insights on the metrics for measuring M&A success, check Fostec.

In the next section, we will explore the common challenges faced during mergers and acquisitions and provide best practices to ensure a successful M&A strategy. Stay tuned to learn how to navigate the complexities of M&A effectively.

Challenges in Mergers and Acquisitions

Despite the potential benefits, mergers and acquisitions come with several challenges that organizations must navigate to ensure success. Understanding these challenges is crucial for any company considering M&A as a growth strategy.

Common Pitfalls in M&A

- Poor Strategic Fit: Not all mergers lead to success. A lack of alignment between the strategic goals of the merging companies can lead to confusion and inefficiency.

-

Inadequate Due Diligence: Failing to conduct thorough due diligence can result in unforeseen liabilities, such as hidden debts or unresolved legal issues.

-

Cultural Clashes: As previously mentioned, differences in corporate cultures can create friction, making it difficult to integrate teams and processes.

-

Overvaluation: Misjudging a target company’s value can lead to overpaying, which can negatively affect financial performance post-merger.

Overcoming Resistance and Managing Change

To address these challenges, organizations must proactively manage change and build a culture that embraces integration.

- Communication is Key: Maintaining open lines of communication with stakeholdersemployees, investors, and customerscan help mitigate resistance and ensure everyone is aligned with the new vision.

-

Engage Employees Early: Involve employees in the integration process to foster a sense of ownership and commitment.

-

Training and Support: Provide training programs to help employees adapt to new systems and processes, reducing uncertainty and anxiety.

“Managing change effectively is the cornerstone of a successful merger or acquisition.” – Jane Smith, M&A Strategist

Best Practices for a Successful M&A Strategy

To enhance the likelihood of a successful merger or acquisition, consider the following best practices:

Establishing Clear Objectives

Before entering into an M&A deal, clearly define your objectives. What are you hoping to achieve? Whether it’s market expansion, access to new technologies, or increased revenue, having specific goals will guide the entire process.

Engaging Stakeholders and Communication

Effective communication with all stakeholders is crucial. Keeping everyone informed throughout the M&A process fosters trust and minimizes uncertainties. This includes:

- Regular Updates: Provide updates on progress and developments.

- Feedback Mechanisms: Encourage input from employees and stakeholders to identify concerns early on.

Continuous Learning and Adaptation

M&A is not a one-time event but a continuous process. Organizations should invest in ongoing education and training for their teams to stay updated on industry trends, regulatory changes, and best practices. This adaptability can significantly enhance the success of future mergers and acquisitions.

Conclusion

In conclusion, mergers and acquisitions represent a powerful strategy for companies looking to expand their operations and enhance their competitive edge. However, navigating the complexities of M&A requires a comprehensive understanding of the process, potential challenges, and best practices.

Recap of Key Points

- Understanding the definitions and types of M&A is essential.

- Thorough due diligence and strategic planning can help mitigate risks.

- Post-merger integration is critical for realizing the anticipated synergies.

- Effective communication and engagement can significantly improve outcomes.

Future Trends in Mergers and Acquisitions

Looking ahead, several trends may shape the landscape of M&A:

- Increased Focus on Technology: Companies are likely to pursue acquisitions that enhance their technological capabilities and digital transformation.

- Sustainability Considerations: As environmental concerns rise, M&A strategies may increasingly focus on sustainability and socially responsible practices.

For more information about the trends in M&A, check out resources like Investopedia and Singhania.

By understanding the strategic value of mergers and acquisitions and implementing the practices outlined in this article, organizations can position themselves for success in an ever-evolving marketplace. Whether you’re a seasoned executive or new to the M&A landscape, these insights will guide you toward making informed decisions that drive growth and enhance your competitive advantage.